In mid-February 2020, Alzheimer’s Orange County offered a webinar on senior care options, featuring speaker Nikki Barrett, a licensed social worker in Orange County. She discussed what levels of care are available, from in-home care to skilled nursing; coverage by Medicare versus Medi-Cal; and the costs that can be associated with each level of care. Though the webinar was not specifically about Parkinson’s Disease (or any disorder), we at Stanford Parkinson’s Community Outreach guessed that this would be valuable information for our community. So, we listened to the webinar and are sharing our notes.

To watch a recording of this webinar, follow this link and scroll down the page until you come to the Online Webinar Archive.

If you have questions, comments or feedback about this webinar, contact Alzheimer’s Orange County at lora.bronson@alzoc.org.

A handout was provided summarizing the different care options. It is available for download here.

For additional resources, see these pages on the Stanford Parkinson’s Community Outreach website:

To discuss these topics, find a Parkinson’s or atypical parkinsonism caregiver-only support group near you. In Northern and Central California, here’s a list of these groups.

Now… on to our notes from the webinar.

– Lauren

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Webinar notes: A Look at Senior Care Options

Presented by Alzheimer’s Orange County

February 11, 2020

Summary by Lauren Stroshane, Stanford Parkinson’s Community Outreach

“There are only four kinds of people in the world. Those who have been caregivers. Those who are currently caregivers. Those who will be caregivers, and those who will need a caregiver.”

– Rosalynn Carter, Former First Lady

Nikki Barrett, LCSW, licensed clinical social worker,is the social work supervisor at Alzheimer’s Orange County. She discussed the different types of care that exist for seniors, coverage from Medicare or Medi-Cal (the term for Medicaid in California), and the typical costs of each type of care.

The demographics of the American population have shifted, with a large rise in the proportion of those over 65 years old. Diagnoses of Alzheimer’s disease (AD) and other neurologic disorders such as Parkinson’s disease (PD) has increased as well. Projected nursing home costs are rising greatly, partly due to the aging of our population but also to the needs of individuals with these diagnoses.

Who are the caregivers?

A disproportionate number of caregivers are women, and it is increasingly common for them to be part of the “sandwich generation” – those who are caring for their parents as well as their children. Many do not have a large income; 41 percent of caregivers have a household income of $50,000 a year or less. Difficult decisions must often be made, such as whether to pay for a child’s college tuition or a parent’s nursing home.

Caregiving for loved ones also constitutes massive amounts of unpaid labor. In 2018, informal caregivers provided 18.5 billion hours of care – a value worth $234 billion. The role can cause an avalanche of effects on the caregiver, affecting them financially, emotionally, physically, and socially. Sometimes, help is necessary both for the well-being of the patient and the caregiver.

Knowing what options are out there can facilitate planning and discussions with loved ones ahead of time, hopefully before a situation becomes critical.

Types of care

There is no one-size-fits-all solution that works for every family; determining what level of care is needed is a highly personal decision, with various cultural, individual, and financial factors that influence the process.

For professionals assisting a family with long-term care planning, it is important to respect where the family is at right now. Rushing the process can be harmful.

The main levels of care available include:

- In-home care

- Home health care

- Adult day health care

- Residential care facility for the elderly (RCFE)

- Skilled nursing facility (SNF)

- Continuing care residential community (CCRC)

These will be explained in more detail below.

The costs of care listed below are median figures for California from 2018. For areas that have a higher cost of living, such as the San Francisco Bay Area, these costs will be higher.

In-home care

A caregiver in the home can assist with daily function on a part-time or full-time basis.

Activities of daily living (ADLs) refer to the essential tasks that most people need to be able to do for themselves on a daily basis.

Instrumental activities of daily living (IADLs) include other activities that are also important for maintaining independence, but may not be as immediately urgent as ADLs. They include activities that require more complex thinking and organizational ability.

“ADL” = Activities of daily living

- Walking

- Feeding

- Bathing

- Dressing and grooming

- Toileting

- Transferring

“IADL” = Instrumental activities of daily living

- Managing finances

- Managing transportation

- Shopping and meal prep

- Housecleaning and home maintenance

- Managing communication

- Managing medications

Needs for assistance can range from having someone to stand-by in case help is needed, to full dependence, requiring someone to complete the task for them.

An in-home caregiver can help with ADLs and IADLs, depending on the individual needs. These services may be provided by a licensed or unlicensed professional. The important distinction is this type of caregiving is not medical care.

Home health care

When medical care is necessary, home health care may be an option. The goal of home health services is to manage an illness or injury at home and keep the patient stable, to provide an alternative in some cases to hospitalization. It requires a doctor’s order and is usually time-limited. Examples of services that home health provides include:

- Wound care

- Nutrition therapy, such as tube feedings

- Intravenous (IV) therapy

- Rehabilitation therapies, such as physical, occupational, and speech therapy

- Medication monitoring

- Caregiver education

Median cost in California (2018) = $26 per hour

- If the individual has a long-term care insurance policy or qualifies under Medi-Cal or Veterans Affairs, some or all of this cost may be covered. Otherwise, it is usually paid out of pocket. (Medi-Cal is the Medicaid program in California.)

Adult day health care

Day programs can be beneficial for many adults, providing limited nursing care or a stimulating social environment during the day that is a change of pace from being at home.

There are two main models of adult day health care: the medical model and the social model. The medical model may provide nursing care, social services, and rehabilitation therapies. The social model provides activities, socialization, and structure to the day. They can promote an individual’s ability to age in place, by living at home but benefitting from one or more of these services.

Some adults may benefit from a mix of in-home care and day health care services, for example, by attending a day program two or three times a week, and having a personal aide for a few hours a day while at home.

Median cost in California (2018) = $78 per day

- If the individual has a long-term care insurance policy or qualifies under Medi-Cal or Veterans Affairs, some or all of this cost may be covered. Otherwise, it is usually paid out of pocket.

Care options that involve placement

For those who can no longer safely live at home, there are a number of options at different types of facilities:

- Residential Care Facility for the Elderly (RCFE)

- Skilled Nursing Facilities (SNF)

- Continuing Care Retirement Community (CCRC)

Residential Care Facility for the Elderly (RCFE)

These include assisted living, board and care facilities, and memory care facilities. RCFEs provide room and board, housekeeping, supervision, and personal care. However, they are not medical facilities, and cannot provide medical care.

Median cost in California (2018) = $4500 per month

- Medicare does not cover RCFE costs.

- There is an assisted living waiver program through Medi-Cal, but individuals must qualify financially. The program has reached capacity and now has lengthy waiting lists.

Skilled Nursing Facilities (SNF)

Health care facilities that provide medical care are called skilled nursing facilities (SNFs), and are often needed after a recent hospitalization. The resident must have a need for nursing care. They may be admitted on a short-term or long-term basis, depending on their medical needs.

Median cost in California (2018) = $8365 per month for a semi-private room

- Medicare sometimes covers SNF care if criteria are met, but the number of days and extent of coverage are limited and require co-insurance.

- Medi-Cal will pay for a SNF when medically necessary but the facility must be licensed and certified to receive Medi-Cal funding.

Continuing Care Retirement Community (CCRC)

This type of community allows people to live in one place that provides housing, residential services, and nursing care, typically for the remaining lifetime of the resident. An individual may be fully independent when they move in, but knows that they will have services available all on the same campus, if and when they are needed. There are about 100 licensed CCRCs in California.

The speaker said there are no recent figures on the costs of CCRCs, but they remain expensive.

- Entrance fees are typically $100,000+.

- Monthly costs range from $3000-$10,000 per month.

Medicare versus Medi-Cal

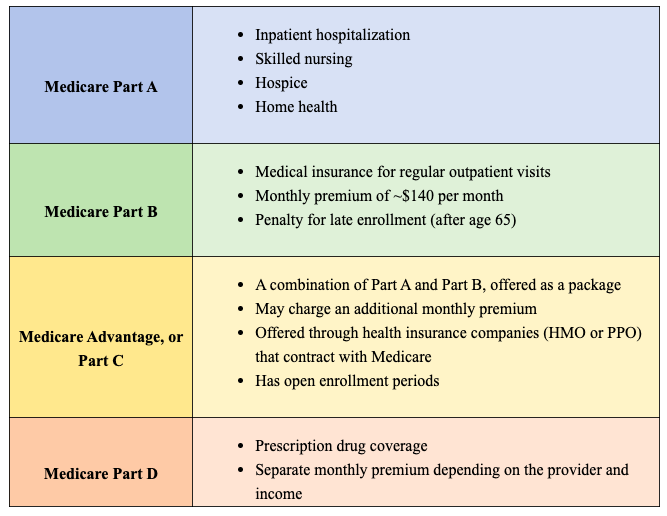

Medicare is a federal program. Anyone over the age of 65 qualifies for Medicare enrollment. Those under the age of 65 who qualify for social security disability can also enroll in Medicare. The different types of Medicare coverage are explained later in this summary.

Medi-Cal is the California version of Medicaid, which is a federal and state program that helps with medical costs for low-income individuals. It offers benefits that Medicare does not usually cover. Qualification for Medi-Cal services is income-based, regardless of age, although the income criteria are different for those under age 65 versus those above 65. In addition to income, there are asset limits.

Components of Medicare

Original Medicare includes Part A and Part B coverage, which are explained below. Sometimes people decide to opt for additional coverage, depending on their needs. There is a common misconception that paying into social security and eventually qualifying for Medicare will guarantee that every medical cost you will incur as an older person will be covered; that’s not necessarily the case.

Medi-Cal Coverage

In some ways, Medi-Cal coverage is more comprehensive than Medicare, but it is much more difficult to qualify. Coverage includes:

- Hospital

- Medical appointment

- Dental

- Vision

- Prescription drug

- Physical therapy

- Occupational therapy

- Mental health services

- Substance abuse

- Durable Medical Equipment (DME)

- Transportation

- Skilled nursing

- Adult day health care

- In Home Supportive Services (IHSS)

Medi-Cal eligibility (SSI)

Individuals with very low income and low resources who qualify for supplemental security income (SSI) are automatically enrolled in Medi-Cal.

- Single: $910 monthly income limit, $2000 asset limit

- Married: $1532 monthly income, $3000 asset

Note: Your primary residence and vehicle don’t count towards the asset limit.

Medi-Cal eligibility (Aged & Disabled Federal Poverty Level)

For those who are age 65 and over who do not qualify under SSI or who are living with a disability may qualify for Medi-Cal under the Aged and Disabled Federal Poverty Level. The income limits are a little higher than for SSI.

- Single: $1271 income limit, $2000 asset limit

- Married: $1720 income limit, $3000 asset limit

Note: Your primary residence and vehicle don’t count towards the asset limit.

Medi-Cal Share of Cost (SOC)

For those who don’t meet the previous criteria, Share of Cost is another way to get some Medi-Cal coverage, though they may not receive the comprehensive Medi-Cal benefits. There isn’t really an income limit for Medi-Cal, it’s that anything over the limit becomes part of the Share of Sost.

Share of Cost (SOC) is like a monthly deductible that must be spent down before Medi-Cal benefits will kick in. This is called a “spend down,” and could go towards paid medical bills, purchasing additional health insurance premiums, or others.

There are a lot of nuances in how Share of Cost is calculated, including something called the Maintenance Need Level (MNL). Net income is subtracted from the MNL to get the Share of Cost. It is not uncommon for the Share of Cost to be hundreds of dollars per month.

Spousal impoverishment laws

These provisions were enacted in 1988 and recognized the severe financial burden a spouse may incur while paying for skilled nursing care. They generally apply to SNF placement but sometimes may apply to services at home or in the community. The “well spouse” is allowed to retain $3000 in monthly income, while the “ill spouse” might live in a care facility.

Question & Answer Session

Please note: This summary omits some questions that were specific to Orange County and not relevant to Northern California. Where appropriate, I added website links to programs mentioned by the speaker.

Q: Can I sign up in advance for the waitlist for Medi-Cal’s Assisted Living Waiver Program?

A: This program has a lengthy waitlist of thousands of people, but you can apply ahead of time. More information is available here: https://www.dhcs.ca.gov/services/ltc/Pages/AssistedLivingWaiver.aspx

Q: How does a family member get paid to be a caregiver?

A: This can happen through the in-home supportive care services program: https://www.cdss.ca.gov/in-home-supportive-services

The care recipient must qualify for Medi-Cal. You will need to fill out paperwork, and the agency will do an in-home inspection during which they will calculate how many minutes they estimate the individual requires assistance per day, to determine the total hours per month that they feel you are justified in caring for them. The on-boarding process contains a number of different steps, and if approved, you must stay on top of submitting timecards. There is an annual re-evaluation to continue in the program.

Q: Do you have info on when there is a life-changing event, such as moving across counties or states, how to change your insurance?

A: Check with your current health insurance to see if they provide service in that area. They may be able to put you in contact with their counter-part in that area, if not. It is important to communicate any transfer of services between both parties. Ask for a reference number for conversations, take notes, and write down who you spoke with.

Q: Do you recommend I buy a gap policy in case there are gaps in my coverage through Medicare or Medi-Cal?

A: Counseling on insurance options is a great idea. Dental and some other services are not included in Medicare; gap plans aim to supplement this. Consider your family’s health needs and speak with an insurance counselor for individualized advice.

Q: Is there a penalty for applying late for Medicare Part D?

A: Unsure; there definitely is a penalty in most cases for applying late to Part A and B, but the speaker was not sure about Part D.

Q: Where do VA benefits fit in here?

A: Someone who already qualifies for a monthly pension and meets other criteria (such needing assistance for some ADLs, being bedbound, etc) may already be eligible for an “Aid and attention” or housebound allowance. It is best to contact the VA for more info.

Q: What is the benefit of working with a geriatric case manager?

A: A geriatric case manager is there to provide coordination of care. They can be especially useful for situations in which the family doesn’t live nearby. They can draw up care plans, coordinate visits, communicate with providers, and provide other assistance.

Q: What is the cost of a geriatric care case manager?

A: Typically $100-120 an hour. They may also have an initial consultation fee.

Q: What does it take to be a geriatric case manager?

A: They usually have a background as a registered nurse (RN) or licensed clinical social worker (LCSW).

Q: How long is the “look back” period when giving away or transferring assets in order to qualify for Medi-Cal?

A: The speaker was uncertain of the exact number of months that Medi-Cal looks back at your finances to see if you qualify, possibly as long as 30 months in the past. They look at assets as well, so giving away money may not be sufficient.

Q: I know an older adult who needs help, lives alone, and doesn’t have any family. How can I approach trying to help them?

A: Those who live alone and experience loneliness or cognitive impairment can often be defensive about their situation. You need to approach them gently, be available, try to build trust. Get familiar with local resources – nearby senior centers? Do they have a case management office that might be able to get involved?

If you’re concerned for their immediate health and safety, contact Adult Protective Services – but this is the “nuclear option” as it can potentially result in state intervention such as removal from their home.

Q: Are there resources for board and care facilities with multicultural staff?

A: There is a tremendous and increasing need for this, as many older adults needing care would benefit from a multilingual, multicultural care environment. A placement specialist may be able to help but it will be a challenge to find this currently. Hopefully we will see more multicultural facilities in the future!